The power of SMS

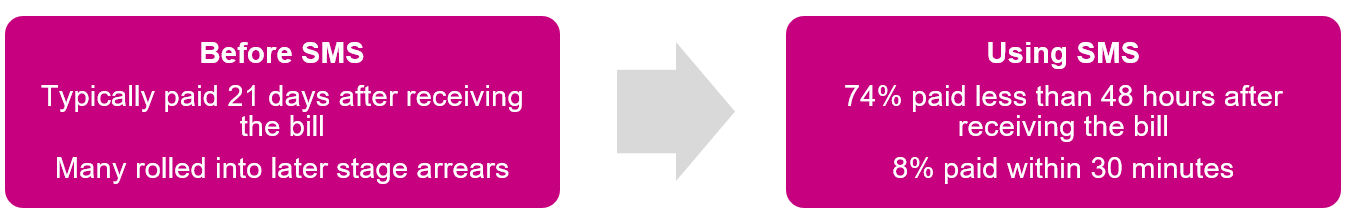

Don’t underestimate the power of the humble SMS – especially conversational SMS chat used as a customer payments channel, particularly powerful in retail banking and utilities, as one case study showed:

There are plenty more instances where SMS has improved collection rates, and in this blog, I will look in detail at one specific case where SMS was used to increase self-service payments when Direct Debit levels plateaued.

Why don’t customers sign up to Direct Debit?

Of course, ideally you want your customers to pay via Direct Debit (or your local equivalent payment method), but the reality is some customers just won’t respond to this strategy and there is a need is for a complementary digital approach, rather than just high effort (and cost) manual payment options. In fact, many organisations we engage with at Arum have reported for several years that Direct Debit sign-up (as a key KPI) has plateaued in their more challenging segments.

There are multiple factors that could account for this customer resistance to Direct Debit, and many may well be associated with COVID and non-COVID related changes in working and income patterns/shocks. These include:

- Fixed payment structure: the debit is only available on a set day (or few days) of the month, which is seldom personalised to the customer, easy to forget, not based on when funds will actually be available, and difficult to change.

- Fees charged by the originating bank: this is typically between £5 and £25 each time a payment is returned, and only needs to happen once or twice to impact future customer behaviour.

Inevitably then, the millions of customers that don’t go onto Direct Debit opt for manually-orientated payment methods (phone or online, following receipt of a letter), which require maximum effort from the customer and lead to delayed payment and operational collections costs for the service provider.

How can SMS chat help with faster payments and increased customer satisfaction?

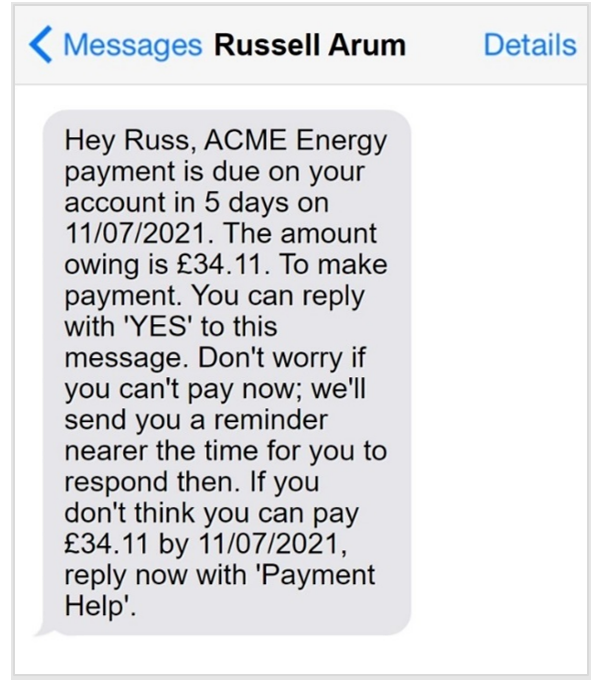

One complementary payment channel to Direct Debit is SMS chat. By implementing something like the example outlined below, you can expect to continue to report your existing Direct Debit levels, e.g., c.60-90% plus c.15% on SMS as a payments channel.

Why is SMS chat so successful as a payments channel?

- Customers self-serve

- No potential bank charges to the customer for returned Direct Debits

- Customers have complete autonomy and flexibility on day and time to pay

- SMS is discreet, ubiquitous and asynchronous

- SMS is simple and quick (replying ‘YES’ to an SMS takes less than 1 second)

- No need to remember any reference or login details

- Payment is made based on availability of funds

- Retries are executed based on the availability of funds

- Real-time feedback is provided if there are any payment issues and can be resolved immediately

- SMS can action payments from more than one payment source

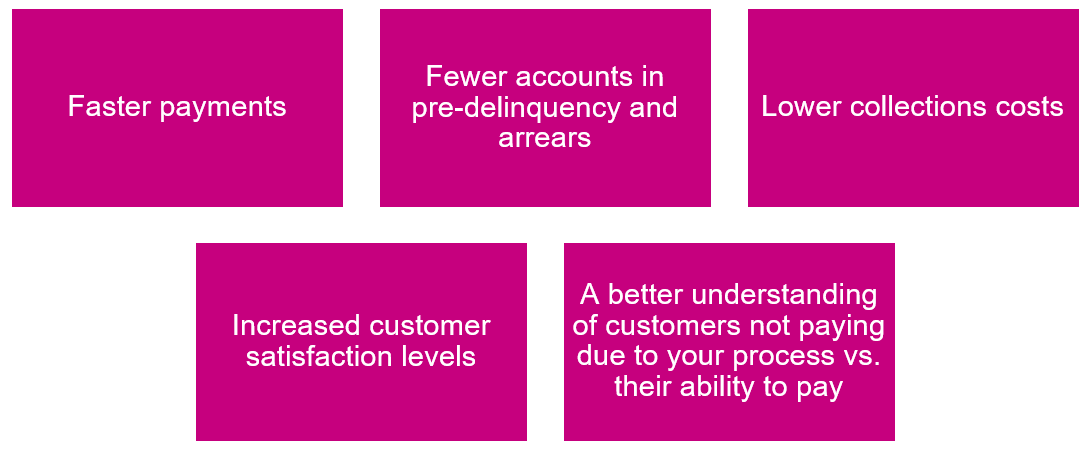

What are the key benefits for creditors?

What about WhatsApp?

I talk to SMS here. However, the journey outlined is ‘messaging as a user interface’, so the same experience on WhatsApp would be the right thing to do regarding an omni-channel strategy. It’s also important to note any cultural or geographical reasons why WhatsApp might be preferable (e.g., in South Africa).

One thing to bear in mind is that WhatsApp messages are subject to certain rules and restrictions that do not apply to standard SMS concerning collecting payment, which can affect approval for sectors such as collection agencies.

Where should you start?

There are several ways Arum can work with clients to accelerate digital transformation and maximise ROI, including:

- Discovery: Assess digital technology, processes, plans, resources and partners.

- Digital Strategy Development/Delivery: Focus on distinct problem areas where the greatest benefit exists. Make best use of technology that exists in your business today, for quick ROI. Identify opportunities using new strategies, technologies and vendors.

- Support delivery programs across themes such as CX, channels, digital functions, payments, and architecture.

- Continuous improvement

I would love to hear from you regarding your challenges in collections. If you want to discuss the specific use case in this blog further, or other ways to simplify the customer collections journey using SMS and other messaging channels, please feel free to get in touch.

Russell Robinson

Principal Consultant and Digital Specialist

Arum