What a difference a few months can make

It was only October 2020 when we published a survey illustrating some of the changing dynamics within motor finance collections.

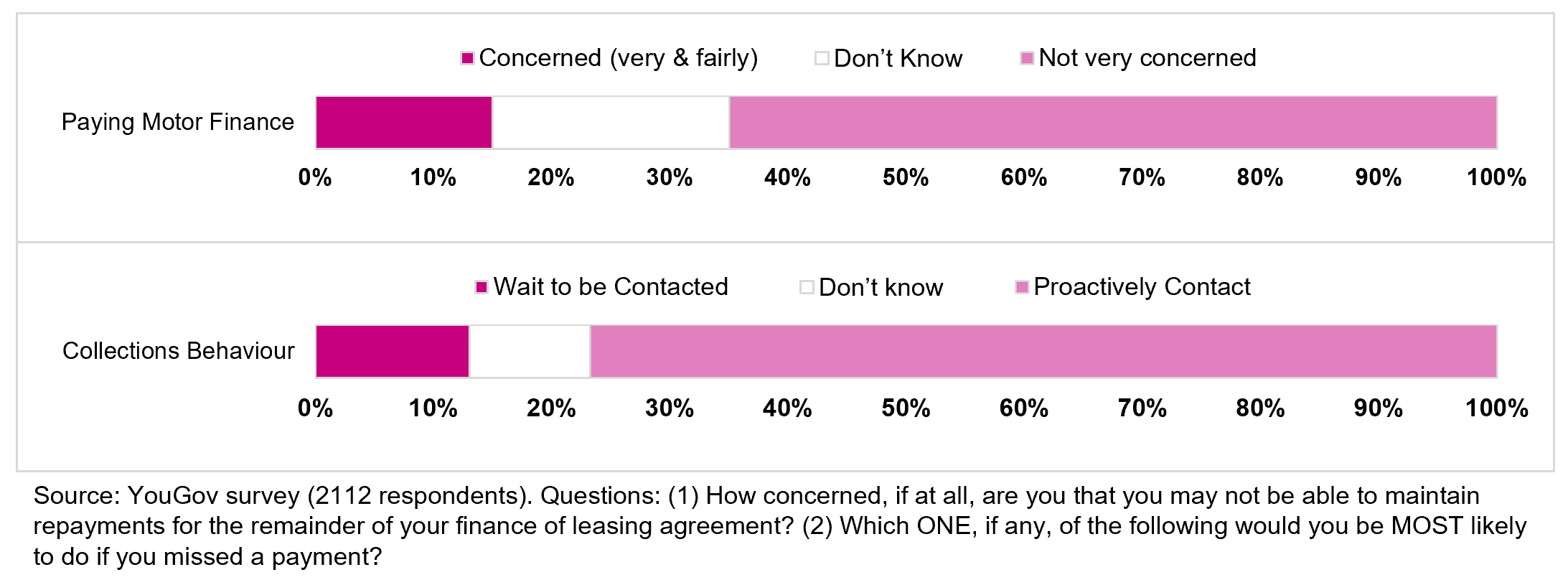

At the time, most people were not very concerned about their car financing and said they would proactively contact their finance company if they missed (or were going to miss) a payment.

With rising sales, especially of second-hand cars, it seemed like the summer sun was still shining and the impact from the pandemic would be, if not rosy, then just fine.

Fast forward to now, and the mood has changed. The pandemic is back, a new virus variant has emerged, and we are seeing all too familiar lockdown restrictions again. Just like the daylight, the mood has darkened.

But dig underneath the surface and there are still green shoots, in particular with the development and investment in new digital channels and strategies.

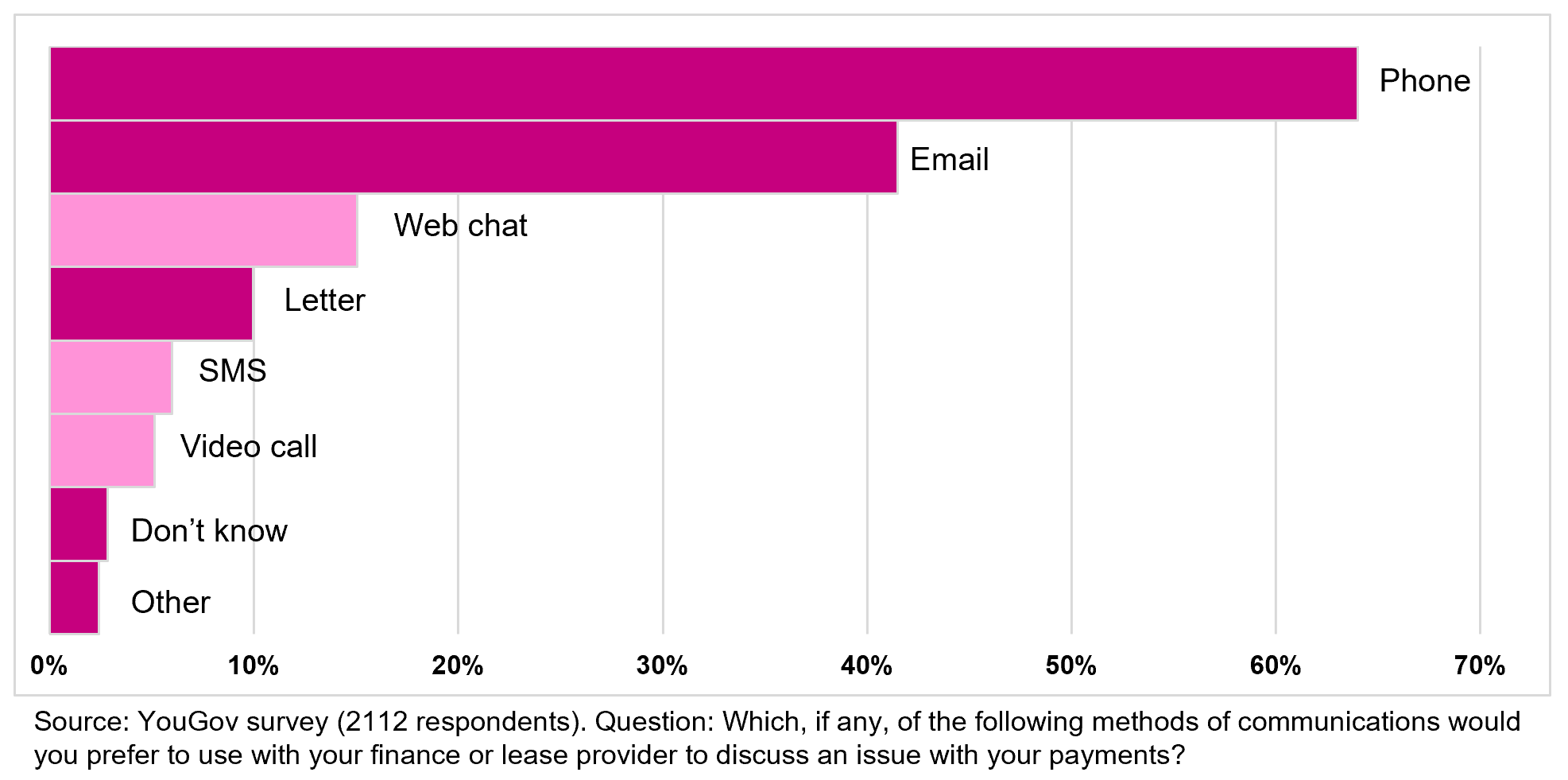

A digital first approach is quickly being discussed and is now expected by many customers

Mobile chat, self-serve portals and even video calls are all increasing in popularity and many businesses have made it a priority investment.

This is a refreshing change for those in the collections industry who have been advocates of this for a while and have felt at the back of the queue for so long.

The question now is not do we have the tools, but how do we use them?

- How do we integrate these new tools into a collections strategy?

- How do they interrelate and interact with each other?

- How do we constantly monitor and improve to maximise benefit from the investment?

With legacy systems, and often legacy strategies, it is all too easy to simply have these new channels as a bolt on. Many have. By contrast, robust integration allows for earlier contact, better customer outcomes and treatment, whilst reducing cost.

Getting there is doable. It just takes some focus, time with of course a sprinkling of expertise.

Top five tips to get started

- Ensure you can measure and monitor the effectiveness of your existing strategies.

- Design new strategies and strategy experiments witheffectiveness measurements in mind.

- Remember this is about good customer outcomes as much as cost reduction- make sure this is considered throughout.

- Select a logical starting point based on market/expert knowledge expertise.

- Leverage champion challenger strategies to test, learn andcontinue to improve.

Of course, at Arum we can help too.

With an in-depth knowledge and extensive experience of collections best practice, we can help provide you with the integration skills, starting state and improvement processes to optimise your collections strategy for this new reality.

If you will pardon the pun, we can help you to get the rubber to hit the road! Contact us to find out more.

Chris Warburton

Principal Consultant

Arum