Open Banking recently celebrated its first birthday. Missed it? Don’t worry, read on to find out what’s been happening and how your business could benefit.

What’s Open Banking?

Open Banking is a secure way to give service providers access to your financial information which they use to deliver new products and services. These might give you a more detailed understanding of your accounts and help you find new ways to make the most of your money.

Both businesses and individuals can benefit from Open Banking, and every provider that uses it to offer products and services must be regulated by the Financial Conduct Authority (FCA) or a European equivalent.

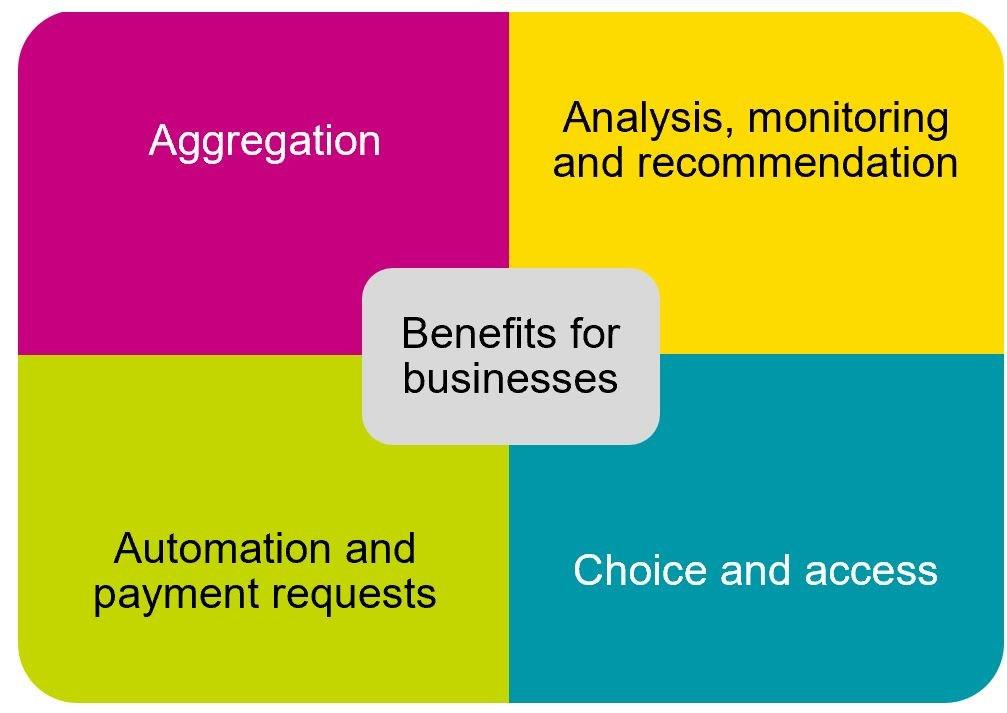

How might you and your customers benefit from Open Banking?

Like any new technology or initiative, the opportunities and benefits are just beginning to be discovered. The FCA considers Open Banking to be an evolution, not a revolution, in financial services.

Here are some examples of how Open Banking might help your business and customers:

- Administration will be easier from seeing banking accounts in one place. For example, Yolt enables multiple bank accounts and credit cards to be viewed through a single app.

- Analysis of banking information will lead to the recommendation of products that are more suited to specific circumstances, or help avoid adverse financial situations. For example, by giving a regulated price comparison website access to account information, results will be based on actual expenditure.

- Customers can pay directly through their bank account, making it cheaper for businesses over traditional card payments. For example, the NatWest Pay trial with Carphone Warehouse enables a payment request to be sent to the customer to confirm payment from their bank account.

- More competition in the banking sector should mean more choice, for example, from the entry of “challenger banks” like Starling Bank which won the award for Best British Bank and Best Current Account 2018.

- For credit scoring customer applications, businesses will now be able to use Open Banking services to help get documented spending history and overcome some challenges credit referencing can have when customers frequently change address. Credit Kudos, for example, uses financial behaviour to measure creditworthiness.

There are currently only 17 live providers with customers at the moment, but we are promised more. A £5m challenge prize is being offered by NESTA to encourage developers of new services, apps and tools that help small businesses get more from their banking services.

Using Open Banking to improve income collection

According to a report by the National Audit Office last year, up to 8.3 million people in the UK are unable to pay off debts or household bills, and 4 in 10 people in the UK cannot manage their money properly. A traditional approach when trying to collect what’s owed has been to ask the customer to complete an Income and Expenditure Assessment. But how can we verify whether this is accurate?

Using bank account data, details of customer spend can be seen. This can make it easy to not only update data, but also help choose the correct recovery strategy, improving your chances of recovering what’s owed, and at lower cost. For any customer, it will also be possible to see if payments are an indicator of genuine difficulty, if they are vulnerable and determine quickly if breathing space is needed. It will be quicker to identify were help might be needed.

Arum's team are specialists in developing customised collection strategies for clients in the public and private sector helping them to implement leading recovery practice and address regulatory requirements. If you want to know more about how we could help you make the most of Open Banking to improve your collection performance, we'd love to hear from you.

Forid Meah

Senior Consultant