Following much talk of COVID impacting consumers’ vulnerability and financial hardship, most lenders are yet to observe a material increase in the numbers of customers falling into arrears, with COVID-based forbearance plans simply becoming “regular forbearance”. However, with several newer cost-of-living challenges facing consumers (surges in fuel and energy prices, economic impacts of conflict, and the National Insurance increase), this will inevitably change.

In this blog, we look at the Financial Conduct Authority’s (FCA) new Consumer Duty, what firms need to do to comply, and how they can ensure they’re achieving fair outcomes for consumers who are already facing financial difficulties and those are new to it.

What is the FCA Consumer Duty?

In December last year, the FCA issued a second draft of their proposed Consumer Duty, which is expected to be finalised by the end of July 2022. Firms will then need to comply by the end of April 2023, giving them just nine months to get everything in place.

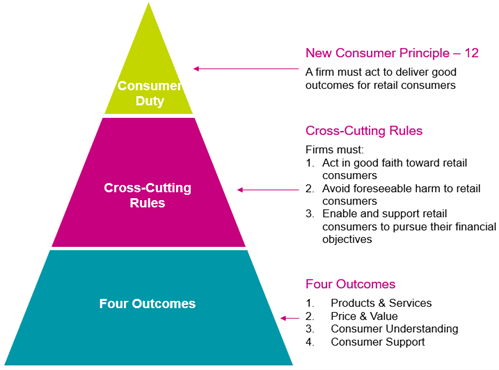

Central to the new Duty is its new 12th Principle: to ensure good customer outcomes at all times:

Further extracts from the consultation draft of the Duty include the following expectations of firms:

- Identify and manage any risks to good outcomes for consumers

- Spot where consumers are getting poor outcomes, and understand the root cause

- Have processes in place to adapt and change products, services, policies or practices to address any risks or issues as appropriate

- Be able to demonstrate how they have identified and addressed issues leading to poor outcomes

If asked, firms will be expected to be able to explain how they reached a decision on the most appropriate intervention, demonstrate how it has delivered good outcomes and, if not, what they have done further to address the issue.

What does this mean for collections?

The collections industry has been working hard for many years already to deliver fair outcomes to customers, based on the expectations of Treating Customers Fairly.

However, the new Duty will take this to another level; firms must ensure that customers’ long-term financial objectives are being met, which will be especially important when reviewing and revising forbearance plans.

There is also a new outcome in the Duty, ‘Consumer Support’, which brings collections into laser focus, with expectations including the inclusivity of digital channels, communications content, contact strategies, and removal of “sludge” practices (barriers to reaching a good outcome on a timely basis).

How can you help your teams deliver fair outcomes?

Collections agents sit on the frontline of delivering fair outcomes to customers, so it’s essential that they are up to speed on the latest tools and techniques when it comes to understanding their needs and how to help them.

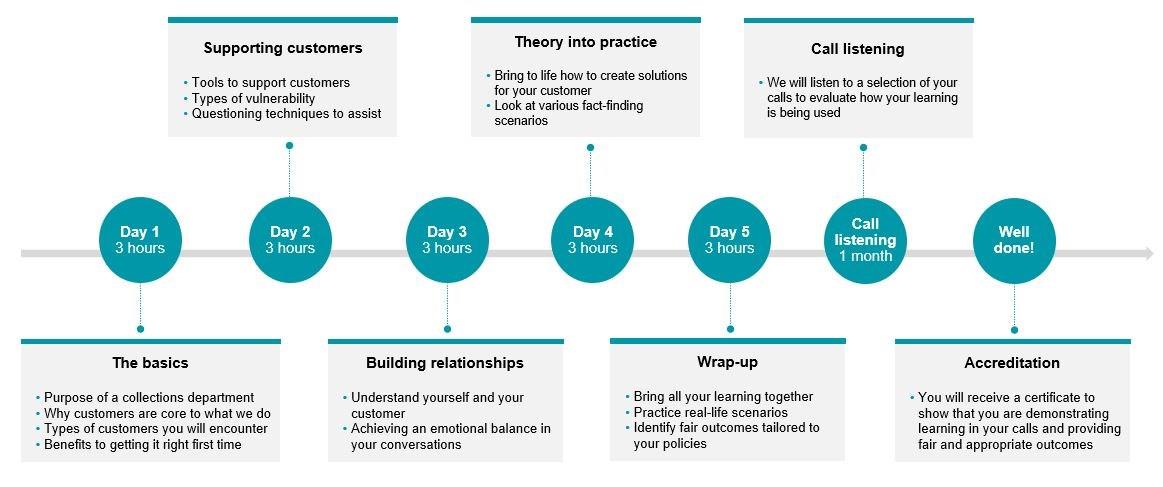

Arum provides a specific training programme for new and existing agents, the ‘Arum Approved Fair Outcomes Accreditation’. Built around your company’s forbearance plans and affordability assessment policy and methodology, we provide five half-day modules covering all aspects of ensuring a good outcome to instances of customer vulnerability and financial hardship.

The training has been designed, and is delivered by, collections practitioners who have a long pedigree of working with organisations to improve collections practices. Why not contact us for more details? We would be delighted to help you.

Nick Walsh and Darren Furlong

Principal Consultant and Lead Consultant

Arum