The idea behind standardisation of collection strategies is to derive a legally compliant collections process that has a minimum cost to execute. Efficiency and scale are key. Within collections, there are several common areas to look at such as basic follow-up processes (e.g. breathing space, hardship and vulnerability).

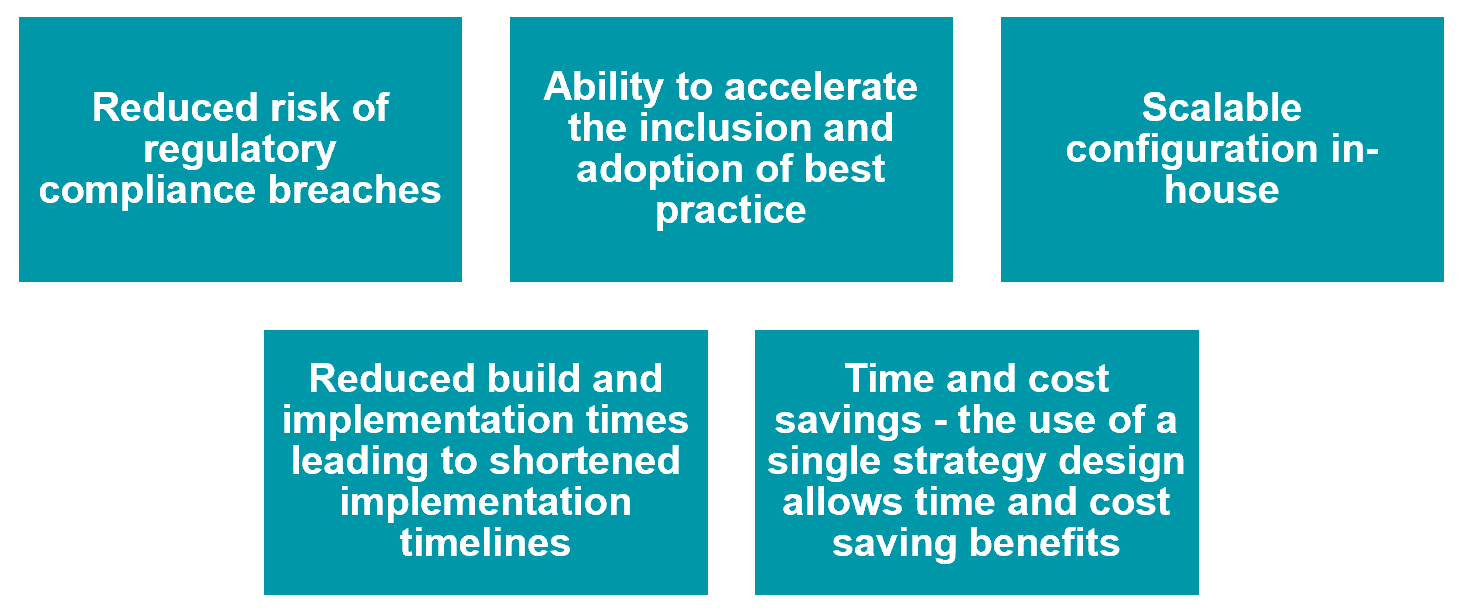

This can have several benefits, including reduced implementation timelines, early benefits realisation and increased control. We do, however, need to approach this subject with a level of caution, as some solutions have historically been too restrictive and needed significant rework to meet requirements. Provided the approach is appropriate with robust scoping and change control, they can however be highly effective.

In this blog, we will look at what opportunities there are around introducing standardisation to contact and collections strategies, as well as the benefits that can be gained by doing this.

What would standard contact channel content look like?

Firstly, we need to understand and map the contact channel process and associated queue requirements. Then, we would consider the regulatory requirements around customer contact and what can be included in letter templates.

Creating standardised communications content and associated templates based on industry and product needs are typically a good first step. For industries such as banking and financial services that are heavily regulated, these should match current regulations and include specific regulatory communications.

Choosing contact channels

Differentiating which customers are contacted via phone by a live agent versus an interactive voice response system, text message, or email is a useful tool where the communication channel can be largely determined by, for example, the risk level of the account.

Standardised utility industry-specific content for communication channels would include templates and pre-built content for the following communications channels:

- Letter (Document Management System)

- SMS (one-way and two-way)

- Email

- Webchat (where supported)

Benefits

- Standardised communication templates will help to speed up the implementation timelines.

- These templates can be tailored by client, based on guidelines and tone leading to a reduced risk of regulatory compliance breaches.

- Provides a best practice approach.

Where can we introduce standardised collection strategies and what are the benefits?

A basic debt follow-up strategy that incorporates a best in-class contact strategy across all channels can be of significant benefit, particularly where there is no or limited existing defined strategy. These can be built with standardised strategies based on characteristics such as risk, type of debt, propensity to pay, with the following benefits:

- Regulatory compliance.

- Good practice contact strategies and a platform for champion / challenger improvement.

- Resource benefits to organisations along with greater process controls by having a standard solution pre-built into the system.

- Reduced system-build and implementation times.

Risk-based collections strategies, length of time to first contact, subsequent contacts and contact channel type are all variables that can be made and pre-configured.

What are the particular areas of opportunity?

- Vulnerability: Once a customer has been identified as vulnerable, clients will typically move the account to a strategy where it will undergo a less severe follow-up process and from where the system will send specific communications which are tailored specifically for vulnerable customers. This is a process that generally will not change much over time, and so is an excellent candidate for standardisation.

- Hardship: This is a follow-up strategy for customers who identify that they are in financial difficulties. They should have the option to complete a standard Income and Expenditure form through an agent and then be presented with a set of appropriate solutions. This will provide a suitable follow-up process to ensure customers stay on affordable plans and keep contact details current. Again, this is a good candidate for standardising the process as it will remain the same for a period of time.

- Payment arrangement follow-up: This is a follow-up process which monitors customer adherence to a payment arrangement, as well as dealing with broken and expiring arrangements. This provides a suitable follow-up process to ensure customers stay on affordable plans. By building a templated set of repayment options and associated monitoring, this can provide a structured framework for clients to develop tailored customer solutions.

Need help knowing where to start?

At Arum, we have over two decades of experience in helping our clients build best in class collections strategies, operations and processes. View our full list of services or get in touch for a free consultation.

Mark Mitchell

Senior Consultant

Arum