Customers want to make payments quickly and get on with their day like it never happened – apologies, we’re not that important to them! But what’s that got to do with Open Banking?

For sure Open Banking has gained a lot of traction by being able to facilitate automated digital affordability checks. These tend to be more accurate than traditional manual telephone-based versions and have been proven to drive better outcomes and payment arrangements more suited to consumer circumstances.

But that’s not all Open Banking can do. When it comes to payments, it can increase payment rates, accelerate the speed of payment, reduce overheads, cut processing costs and prevent scams.

How does it work?

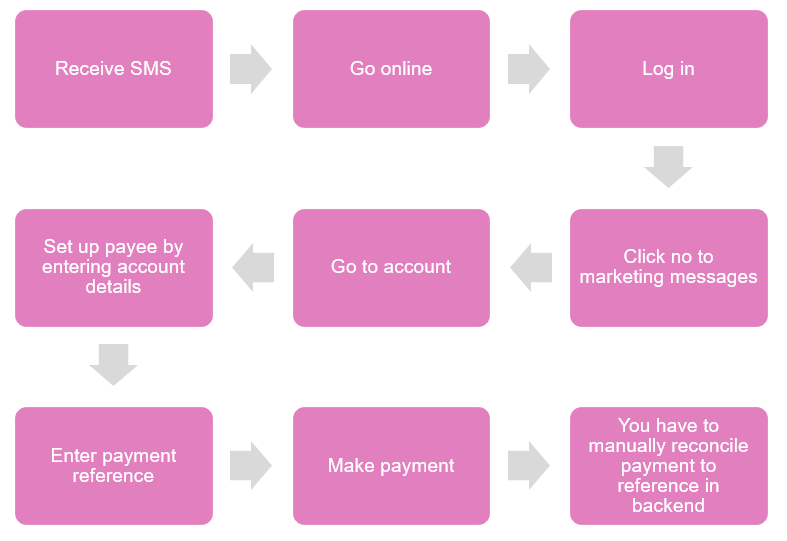

With a traditional approach, the customer enters arrears, and several steps need to take place to complete payment:

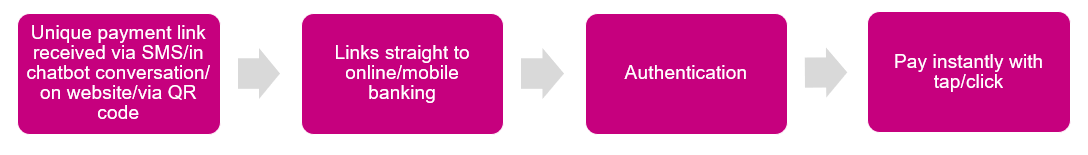

The good news is, it doesn’t have to be like this anymore! The ‘Pay direct from my bank account option’ is now more straightforward with Open Banking:

As you can see, the process is much simpler – no need to enter account details, reference numbers, or even payment amounts – the Open Banking API sorts this out and pre-populates the required information. And you don’t have payments reconciliation problems at the backend either. And did I mention that the processing costs are much, much lower than card payments?

Regarding the increase in social engineering scams, these are on the rise (including phishing attacks on SMS); they erode customer confidence and may even hamper your digital collections efforts. As Open Banking payments use strong customer authentication on trusted digital banking channels, this will reassure customers as you will never ask them to enter any personal or account information to pay.

Fraudsters typically target the path of least resistance, so make sure your collections processes aren’t helping them.

Who will use it?

Did you know that 2.5 million consumers already use Open Banking in the UK, more double the number using it before the COVID pandemic? Open Banking is quickly becoming mainstream.

After implementing Open Banking payments, one lender quickly saw Open Banking payments cannibalise nearly a third of their card payments. And that figure is growing fast.

If you are interested in understanding more about Open Banking payments and how it can help your organisation and your customers, please contact me.

Russell Robinson

Principal Consultant and Digital Specialist

Arum