The debt advice charity, StepChange, recently published a report (Measuring Client Outcomes), which details outcomes across various groups of customers, following the receipt of debt advice, after specific periods of time. Whilst some of the outcomes are not surprising, the report describes marked differences in outcomes especially at the 3-month stage following advice.

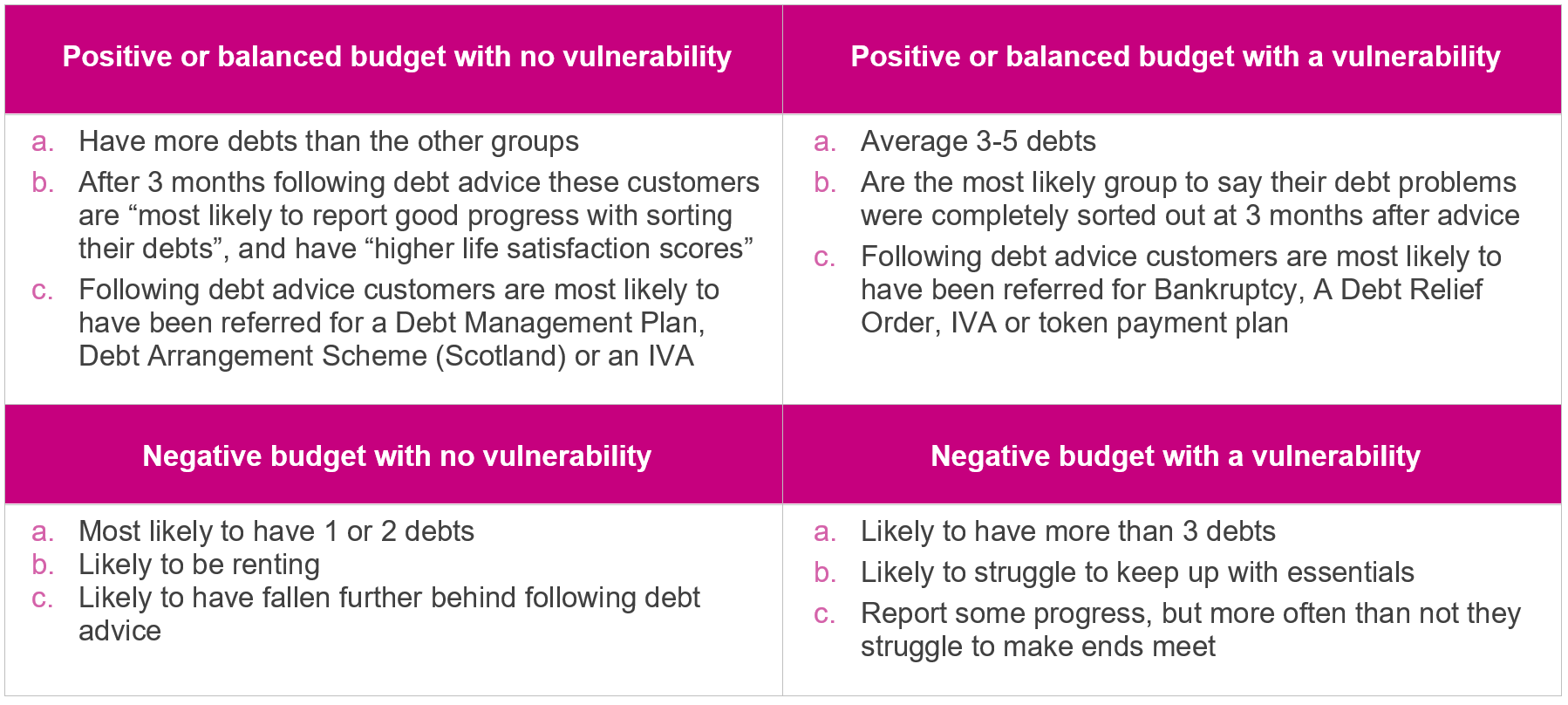

Results at the 3-month stage for 4 identified customer types

A key outcome for StepChange is the wellbeing of the customers following advice, and more than half (56%) said they felt able to deal with day to day life better than before. However, it will come as no surprise that only 28% of customers with a negative budget and a vulnerability said they are dealing better with day to day life than before.

The full report has many interesting facts and statistics and is recommended reading. It can be found here.

So what can creditors do differently?

- Early intervention and identification (especially of a vulnerability), is key. Current technology advances such as AI and Machine Learning, whilst not widely adopted yet, will make a difference. As StepChange have stated, the majority of customers report better wellbeing following advice, and the sooner this occurs the better.

- Ensure there is a robust vulnerable process. Whilst certain industries are more advanced in their approach to handling vulnerable customers, others have little, or no, processes in place. This should be reviewed without delay.

- We would encourage private firms to undertake similar analysis of their own forbearance or hardship programmes, as StepChange have. This process can help ensure you continually improve treatments for vulnerable customers or those customers in financial difficulty. An important area and one where improvement can really help customers in need.

For over 20 years, Arum has been helping organisations across various industries improve their processes, insights, and ultimately client and customer outcomes, in a compliant and controlled way. If you would like to discuss how we can help you please contact us, or read more about our services.

Nick Walsh

Principal Consultant

Arum