The Bank of England's Credit Conditions Survey (CCS) is a quarterly survey that collects data on lending conditions from a range of lenders in the UK.

The CCS for Q1 2023 showed that lenders reported an increase in mortgage defaults, and this has continued into Q2 2023. This means that more lenders reported an increase in default rates than reported a decrease.

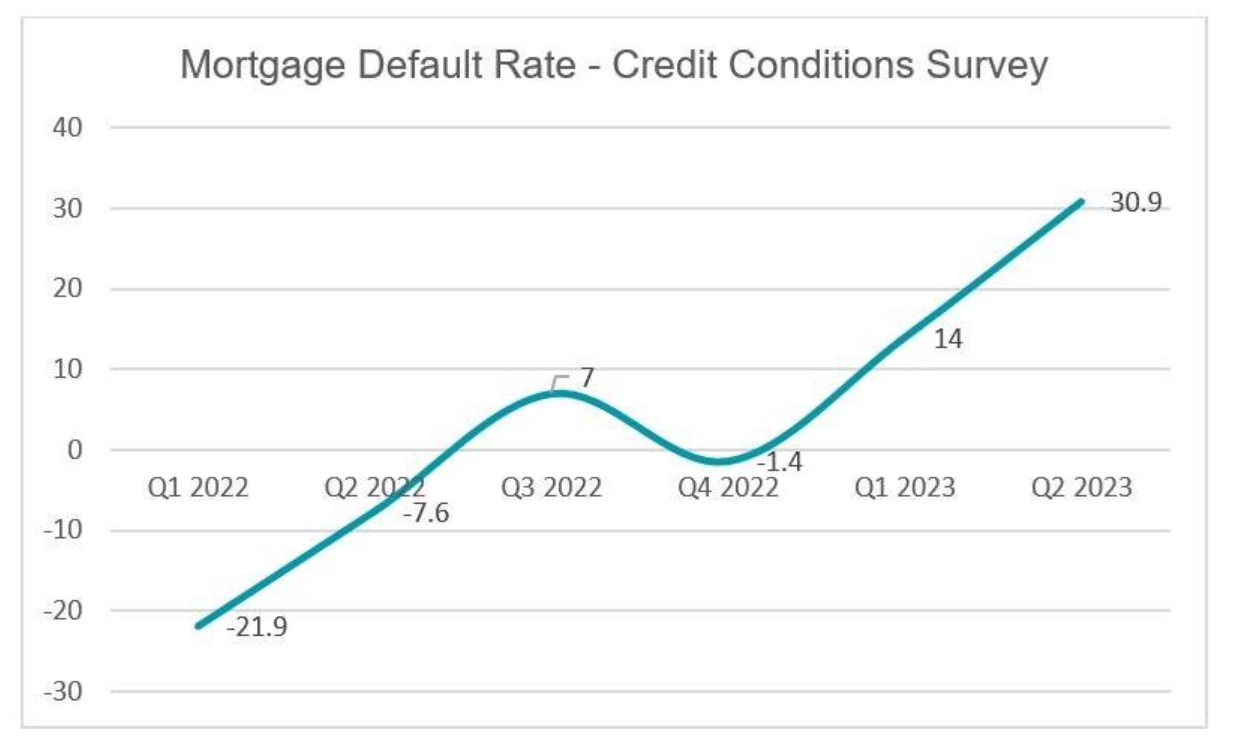

The net percentage balance is a measure of the balance of opinion among lenders, and it is scaled to lie between (+/-) 100. A net percentage balance of 100 means that all lenders reported an increase in default rates, while a net percentage balance of minus 100 means that all lenders reported a decrease in default rates.

The CCS survey, which was published yesterday, found that mortgage defaults in the three months to the end of May increased to 30.9 on the CCS index, up from 14 in the first quarter of 2023.

We are all aware of the factors driving this, and we can reasonably expect that the trend will continue.

Recently the UK Government, in conjunction with bankers, outlined a number of measures to help struggling consumers, and our blog on this can be found here.

At Arum we continue to monitor developments, supporting lenders with the design and implementation of collections processes to support good customer outcomes. If you would like to discuss anything I’ve raised here or how we can help you, please email me.

About the author

Nick Walsh

Principal Consultant

Arum

Nick is a collections and recoveries professional with over 30 years’ experience, domestically and internationally. He has enabled many organisations, large and small, across multiple sectors, to fast track to an optimal operating model designed specifically for each organisation, taking into account their constraints and with due regard to regulatory compliance and customer experience.